According to one recent survey, 21% of insurance companies are actively preparing their workforce for AI-based systems that are collaborative, interactive, and explainable. This suggests that decision-makers are prioritizing investments in artificial intelligence, as the insurance industry, like many others, is on the verge of a seismic, tech-driven shift. One reason for this growing interest is the need to provide more personalized insurance services, which requires automation of operational processes. AI in insurance can achieve this by automating tasks traditionally performed by humans, resulting in faster and more accurate results without fatigue or errors.

What is artificial intelligence in the insurance industry?

Artificial intelligence (AI) refers to the ability of a computer to think, learn, and behave like a human. Through the interpretation of data, AI is able to perform various tasks requiring human intelligence.

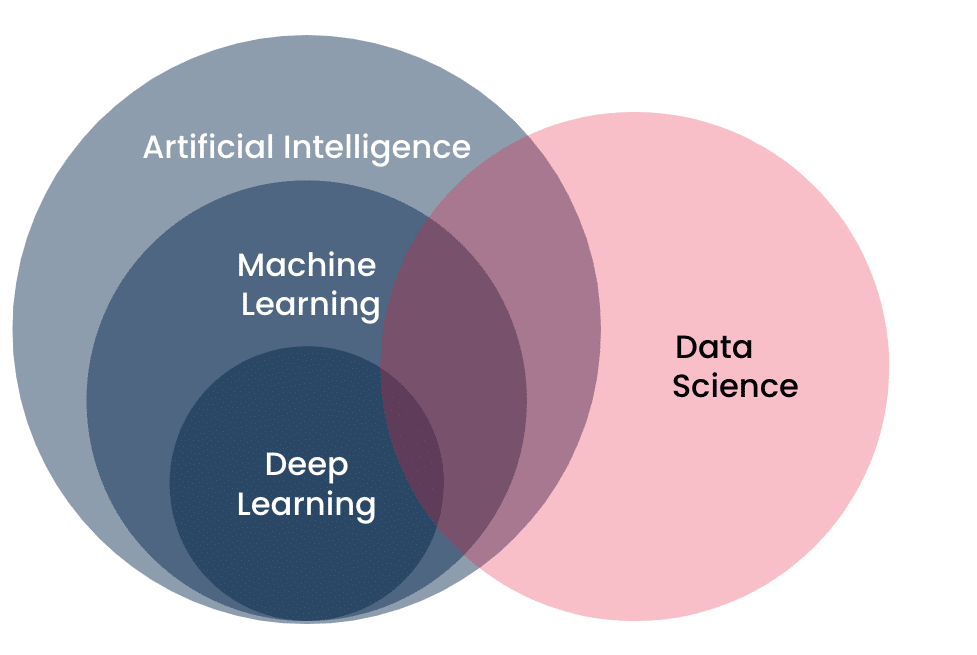

Machine learning, a specific application of AI, leverages data to make predictions and solve problems. Deep learning is a branch of machine learning, and in turn, machine learning falls under the larger umbrella of artificial intelligence. Similarly, AI and data science intersect significantly, though each field extends beyond this common ground. The true innovation and breakthroughs often occur in the shared space among AI, machine learning, and data science, leading to a blurred line between the terms. Therefore, when these terms are interchanged, it’s mostly accurate enough for general understanding. It’s this interconnected and overlapping functionality that one should bear in mind.

Despite its futuristic sound, AI is already a part of our everyday lives. When, for instance, your streaming service suggests a new show based on your viewing history, that is AI at work.

Although slower to adopt new technologies compared to other industries, insurance companies have begun implementing AI and related tools in their business practices. Due to the complexity of the insurance industry, AI and machine learning techniques have nearly endless possibilities to improve efficiency and accuracy in the field.

Benefits of advanced AI technologies for the insurance sector

AI in insurance is now enabling companies to unlock and analyze much more data in ways that people alone simply cannot. This provides insurance companies with a number of benefits, like speeding up customer service, faster claims settlements, and better fraud detection or risk management. AI in insurance is revolutionizing the industry in many ways, including:

Improved routine operations

AI-powered chatbots can initiate processes and disseminate information without human intervention, thus making operations smooth, quick, and error-free. Chatbots can also cross-sell and upsell products based on a customer’s profile and history, while automated repetitive processes allow for easy scaling and better utilization of human resources.

AI-enabled chatbots can efficiently facilitate the claim-reporting process so that customers can report incidents anytime, anywhere. The chatbots can then disperse the information for further processing, handling the first notice of loss with minimal or even without human intervention.

Improved loss estimation and safety

The emergence of groundbreaking AI technologies, including Machine Learning, Deep Learning, and Optical Character Recognition (OCR), has simplified and expedited damage assessment. This can be achieved simply by uploading an image of the damaged item.

The ability to forecast potential losses and offer recommendations has made the process of loss estimation both speedy and proficient. Additionally, AI can identify repeated patterns that may be abnormal or fraudulent.

AI streamlines the fraud detection process by regulating all data capture, claims creation, authorization, approval, payment tracking, and recovery tracking processes. This saves both time and costs, reducing claims regulation costs by 20-30%, processing costs by 50-65%, and processing time by 50-90% while improving the customer experience.

Use cases of AI in insurance: 5 solutions to implement now

Here are five proven artificial intelligence solutions for the insurance industry that companies can and should implement now:

1. Automating Customer Service

In the insurance industry, good customer service is paramount. Even in a sector as change-resistant as insurance, it’s essential to understand customer sentiment to provide the best experience possible. Studies have shown that customers are likely to spend 140% more after having a positive experience, and unhappy customers are likely to tell an average of 16 people about their negative experiences, creating a bad image for the company. With the advent of AI chatbots, customers can easily navigate through numerous queries without human intervention, potentially resolving inquiries and crises in no time. Of course, human customer service agents are necessary for more complex concerns, but automated customer service can handle most of the remainder, providing customers with a seamless experience.

AI-powered chatbots, emailbots, and callbots are the perfect means to automate customer service. They are fast, efficient, and always available.

Chatbots can automate 100% of the chat process, answering 60% of questions automatically, forwarding 20% of conversations to salespeople if a sales opportunity is signaled, and sending 20% of complex, non-repetitive questions to the right agents the first time. Emailbots can help to automate email communication, answer frequently asked questions, forward emails to the right agents, prioritize emails, and gather accurate statistics about the reasons customers contact the business. Call automation bots can transcribe and analyze a call in real-time, forwarding it to the right specialist or answering questions automatically without any human assistance.

Such machine learning solutions help to automate routine tasks and free employees to focus on higher-value tasks, thus improving customer experience and engagement. AI enables self-service queries on policy issuance, endorsements, cancellations and renewals. AI solutions are also able to increase loyalty through effective bundling and cross-selling, helping insurers get the right products to the right customers at the right time.

2. Claims Management and Processing

In the insurance industry, the efficiency of an insurer is measured by how quickly and accurately they can settle claims. Traditional claims processing can be slow and prone to errors, which can lead to customer dissatisfaction and increased costs for the insurer. But imagine 10 claim handlers doing the work of 40 with higher quality results; this is what AI can deliver. With the use of AI, insurance providers can streamline and automate many of the time-consuming tasks involved in the claims process.

For example, machine learning models like speech/voice or text analytics can understand and transcribe spoken words and connect content to a claim. This allows insurers to extract data from documents much more easily, resulting in faster claims processing times. Additionally, by automating many of the repetitive and standard tasks involved in claims management, insurers can reduce the number of personnel needed for claims processing, increase productivity, and reduce costs.

AI can also be used to improve underwriting processes by leveraging data collected from IoT devices such as smart home assistants, fitness trackers, and healthcare wearables. Such data enables insurers to make better decisions and reduce risks.

Furthermore, AI can assist in claims assessment by analyzing images, sensors, and historical data to determine potential costs. This helps insurers settle claims quickly and accurately, leading to higher customer satisfaction and cost savings for the insurer. Overall, AI used in the insurance industry can increase efficiency, improve customer satisfaction, and lower costs.

3. Fraud detection

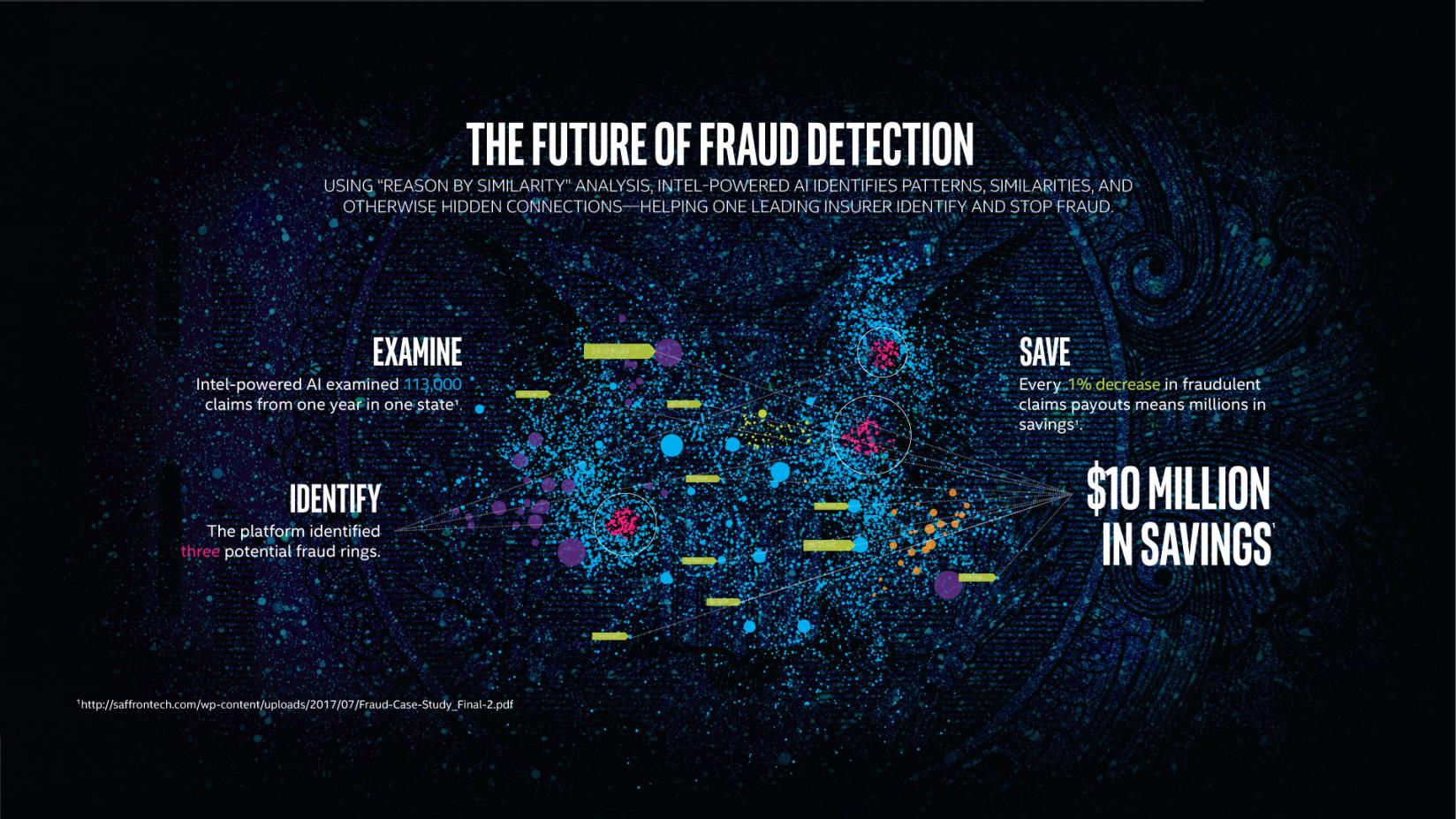

Insurance companies are constantly battling fraudulent claims, which can cost them billions of dollars annually. Fortunately, artificial intelligence (AI) has emerged as a powerful tool to help insurers to detect and prevent fraud.

Machine learning algorithms allow AI to learn and improve over time, becoming better at identifying signs of fraud or anomalous behavior that human analysts might miss. By raising real time alerts and sending suspicious claims for further review, AI helps insurers make better decisions and prevent fraudulent claims from slipping through the cracks. For instance, the Estonian Tax and Customs Board recently implemented such an AI-enabled system for tax fraud detection.

Of course, professional criminals are always looking for new technologies and ways to stay ahead of the curve, and they will adapt their tactics to avoid detection. But the scalability and efficiency of AI and machine learning make it a cost-effective way for insurers to stay ahead of the game. While human data scientists may need to constantly iterate their analyses to keep up with evolving fraud indicators, machine learning algorithms can train themselves over time based on observable changes in the underlying data.

The potential cost savings of using AI technology to detect and prevent fraud are enormous. Non-health insurance fraud alone is estimated to cost more than $40 billion per year, driving up the premium cost for families by hundreds of dollars annually. By using AI to identify patterns and anomalies in insurance applications that might indicate fraud, insurers can not only save money but also provide more accurate and fair insurance coverage to their customers.

4. Risk Management

AI has revolutionized the insurance industry by enabling proactive risk management and granular underwriting based on the vast amounts of data available to insurance companies. By leveraging AI and big data, companies can effectively identify and manage risks while adhering to their policies and risk culture. The adoption of AI does not require a complete overhaul of existing processes; rather, it enhances them to fill any gaps. With AI, thousands of loss reports can be examined, and trends, which would otherwise take months for a specialist to perform, can be identified.

AI does not replace the specialists assessing risk, but instead improves their work by providing them with access to quality information, enabling better risk scores, break-even price prediction, dynamic pricing compared to competitors, and monthly payment prediction using AI technology. In the past, underwriting was heavily reliant on manually filled forms provided by the applicant, which could result in inaccurate risk assessment due to errors or dishonesty.

Internet of Things (IoT) devices and improved connectivity have enabled insurers to access larger datasets with more accurate information. Natural Language Processing (NLP) also allows insurers to access relevant information more efficiently and provide more accurate assessments.

Research has shown that AI in the underwriting process has numerous benefits, including 83% accuracy in modeling potential markets, a 10-fold reduction in throughput time, and a 25% improvement in case acceptance. AI has transformed the insurance industry by providing more efficient, accurate, and effective risk control and underwriting capabilities.

5. Human error reduction

The insurance industry’s distribution chain is complex and error-prone due to human involvement. AI algorithms can reduce errors and accelerate a process by automatically passing information between sources, reducing data entry, and increasing accuracy. Better data from machine learning or deep learning techniques can benefit both customers and insurers by allowing insurers to develop better products based on accurate assessments and providing automated advice to customers based on their business information. This approach eliminates the need for customer expertise or agent involvement.

AI can streamline the fraud detection process by regulating all data capture, claims management (creation, authorization, approval), payment tracking, and recovery tracking processes. This can save time and costs, reducing claims regulation costs by 20-30%, processing costs by 50-65%, and processing time by 50-90% while improving the customer service experience.

Trends and challenges in insurance in 2023-2033

Over the next decade, four core technology trends closely linked with AI will reshape the insurance industry, experts from McKinsey&Company claim.

-

Data Dominion: Harnessing the Power of Analytics

The first is the explosion of data from connected devices, with a projected one trillion connected devices by 2025. This influx of data will enable carriers to understand clients better, resulting in more personalized pricing and real-time financial services delivery.

-

Robotics Revolution: Redefining Human-Machine Interactions

The second trend is the increased prevalence of physical robotics, which will alter human interaction with the world. Additive manufacturing, autonomous drones, and self-driving vehicles will impact risk assessments, customer expectations, insurance processes, and product channels.

-

Ecosystem Synergy: Uniting Through Open-Source and Shared Data

The third trend is open-source and data ecosystems, with entities coming together to share data for multiple use cases under a common regulatory and cybersecurity framework.

-

Thinking Machines: Cognitive Technologies Transforming Insurance

Finally, advances in cognitive technologies, such as convolutional neural networks and other deep learning technologies, will become the standard approach for processing complex data streams generated by “active” insurance products tied to individuals’ behavior and activities. These advancements will enable carriers to access models that continuously adapt to the world, enabling new product categories and engagement techniques while responding to real-time shifts in underlying risks or behaviors.

How can insurance providers stay competitive with the accelerating changes technology brings?

Insurance companies can prepare for accelerating changes brought about by technology by taking the following steps:

- Get smart on AI-related technologies and trends

Insurers should invest time and resources in building a deep understanding of AI-related technologies, including AI life cycle, machine learning, data science, and external data ecosystems. By exploring hypothesis-driven scenarios, insurance companies can understand where and when disruption might occur and what it means for certain business lines. This effort should be designed to test how technology works and how successfully the carrier might operate in a particular role within a data- or IoT-based ecosystem. - Develop and begin implementation of a coherent strategic plan

Building on insights from AI explorations, insurers must decide how to use technology to support their business strategy. This will require a multiyear transformation that touches operations, talent, and technology. The execution plan of an AI project should address all four dimensions involved in any large-scale, analytics-based initiative—everything from data to people to culture—and should outline a road map of AI-based pilots and POCs. - Create and execute a comprehensive data strategy

Data is fast becoming one of the most valuable assets for any organization. Carriers must develop a well-structured and actionable strategy with regard to both internal and external data. This includes organizing internal data to support the agile development of new analytics insights and capabilities and gaining access to high-quality external data sources through a multifaceted procurement strategy alongside building a data pipeline. - Create the right talent and technology infrastructure

To ensure that every part of the organization views advanced analytics as a must-have capability, carriers must make measured but sustained investments in people, outsource machine learning, or create a machine learning team. The insurance organization of the future will require talent with the right mindsets and skills, including being technologically adept, creative, and willing to work at something that will continually evolve. Doing so will require a conscious culture shift toward embracing AI technologies as a critical capability across the entire organization.

These steps involve exploring the potential of AI and related emerging technologies together, developing a strategic plan that addresses all aspects of the business, creating a comprehensive data strategy, using AI tools, and investing in the right talent and technology infrastructure. To succeed in the future insurance industry, companies must be able to use data to predict and prevent risks and to provide unique and holistic customer experiences.

To wrap it up

AI is changing the insurance industry, and companies should act now to gain a much-needed edge over the competition. To overcome the previously mentioned challenges, MindTitan has developed an easy roadmap solution for insurance companies with the following steps:

- With your team, determine the business problems you wish to solve and decide on which business decisions and processes you wish to improve.

- The next steps are to figure out whether AI is the right solution for your business growth and to solve business problems and optimize those processes. Contact MindTitan to do a workshop with your company.

- Create an AI strategy with MindTitan to understand which AI use cases to tackle and what the required infrastructure and steps to execute your ideal suitable AI model could be.